How to Fill Out a W-8BEN Form as a Canadian Author

/As someone who worked as a tax accountant for almost twenty years and earned a Chartered Professional Accountant designation, I found this form confusing when I first had to fill it out for one of my clients. When I realized I would fill out many copies for myself as a Canadian author distributing books through US-based websites, I created a template so I didn’t have to spend so much time figuring out what went where.

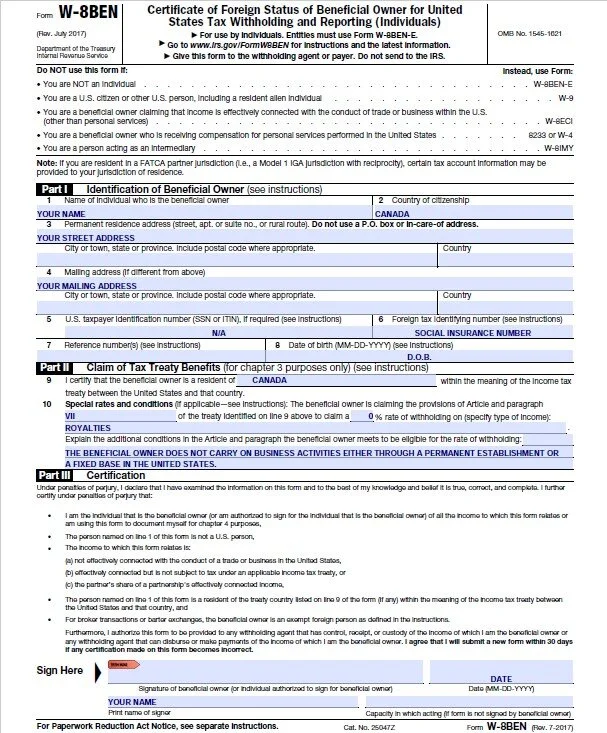

The following information is from the point of view of a Canadian author (and is current as of April 2023). If you are an author in another country, there may be differences in how you complete this form.

What is the W-8BEN Form?

This is an Internal Revenue Service form that tells the IRS you are a Canadian, and therefore, for US tax law, you are a foreigner. This form is for individuals (ie. people doing business as a sole proprietor). If you are doing business as a corporation, partnership, or other form of business entity, you need to use Form W-BEN-E.

The other key to this form is Part II - Claim of Tax Treaty Benefits. Because Canada and the United States have a tax treaty, it does not require distributors in the US to deduct income tax on royalties paid to you. Very important.

Most book distributors (Amazon, Draft2Digital, Google Play, etc.) have an electronic version of ths form, but the information required is the same. You will not get paid if you do not fill out this form, and if you fill it out incorrectly, you may have tax deducted from your earnings at the rate of 30%—ouch.

Let’s take a look at the parts of the form.

Part I - Identification of Beneficial Owner

The use of “beneficial owner” here is confusing. This is simply where you enter your name and address (both street and mailing). For line 5, I am assuming you are a Canadian taxpayer with zero ties to the US, and therefore no tax reporting requirements in the US. If you are unsure about this, contact a US accountant to confirm, otherwise, enter “not applicable” on this line.

For line 6 (foreign tax identifying number), enter your Canadian social insurance number. Remember, this is an IRS form, so the word “foreign” is from the point of view of the IRS. In almost all instances you will leave line 7 blank, because the platforms where you will distribute your books will not provide you with a reference number.

Part II - Claim of Tax Treaty Benefits

For line 9, enter “Canada.” Under the tax treaty between Canada and the US, Canadian taxpayers pay a 0% rate of withholding tax under Article VII. This is as technical as I will get on this point. Just know that you will complete line 10 as follows (bold items go in the blanks):

The beneficial owner is claiming the provisions of Article and paragraph VII of the treaty identified on line 9 above to claim a 0% rate of withholding on (specify type of income): royalties.

Then, where it asks you to explain how you are eligible for the rate of withholding enter: The beneficial owner does not carry on business activities either through a permanent establishment or a fixed base in the United States.

Note: This form is for individuals (if you are operating your author business as a proprietor, you are an individual). If you operate your author business as a partnership or corporation, you will need to fill out W-8BEN-E (the same form only for entities).

Part III - Certification

Now, all that’s left is declaring you haven’t falsified the form. Read this section, then sign, date, and print your name. Because you are completing the form electronically, the signature and name-printing parts may be combined.

If there’s anything I haven’t covered here or you're curious about a certain line item, you can find detailed instructions for completing the W-8BEN Form on the IRS site.

I have filled out this sample PDF you can print for reference when you need to fill out this form. Please leave questions you have in the comments below, and I’ll do my best to answer them.

The Prosperous Authorpreneur is now available on Amazon.

Click image to view PDF version of sample form.

Did you find this post helpful? Get this information and more in The Prosperous Authorpreneur: Save Time and Money to Self-Publish Without Burning Out or Going Broke. Available in ebook and audio, on Amazon and in my shop. Click the image below to learn more.